3 Ways You’ll Win When You Buy a Home This Year

There are so many great reasons to purchase a home, and over the past year, we’ve realized more of them than we ever thought possible. If you’re a first-time homebuyer, having a home of your own can give you a greater sense of security and accomplishment in a time that’s largely uncertain. If you’re a repeat buyer looking for your dream home, making a move might give you the space or features you need to find greater success and happiness in a new normal way of life. Whatever your motivations are, here are three reasons why becoming a homeowner now may help you win big in the long run.

1. Buying a Home Is a Great Investment

Several recent reports indicate that real estate is still a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps you build equity, a type of forced savings that grows your net worth. According to the latest Equity Report from ATTOM Data Solutions:

“The count of equity-rich properties in the fourth quarter of 2020 represented 30.2 percent, or about one in three, of the 59 million mortgaged homes in the United States. That was up from 28.3 percent in the third quarter of 2020, 27.5 percent in the second quarter and 26.7 percent in the fourth quarter of 2019, despite the ongoing economic damage caused by the worldwide Coronavirus pandemic.”

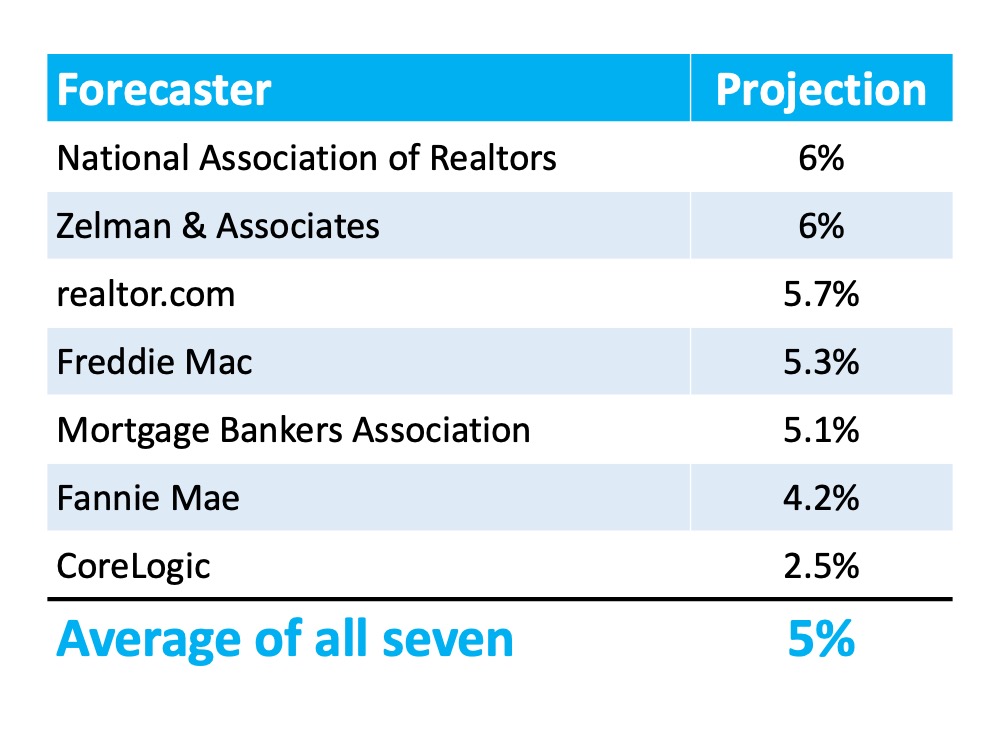

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to an average of 2.9% in 2021.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to likely get more house for your money.

3. Investing in Your Future Pays Off

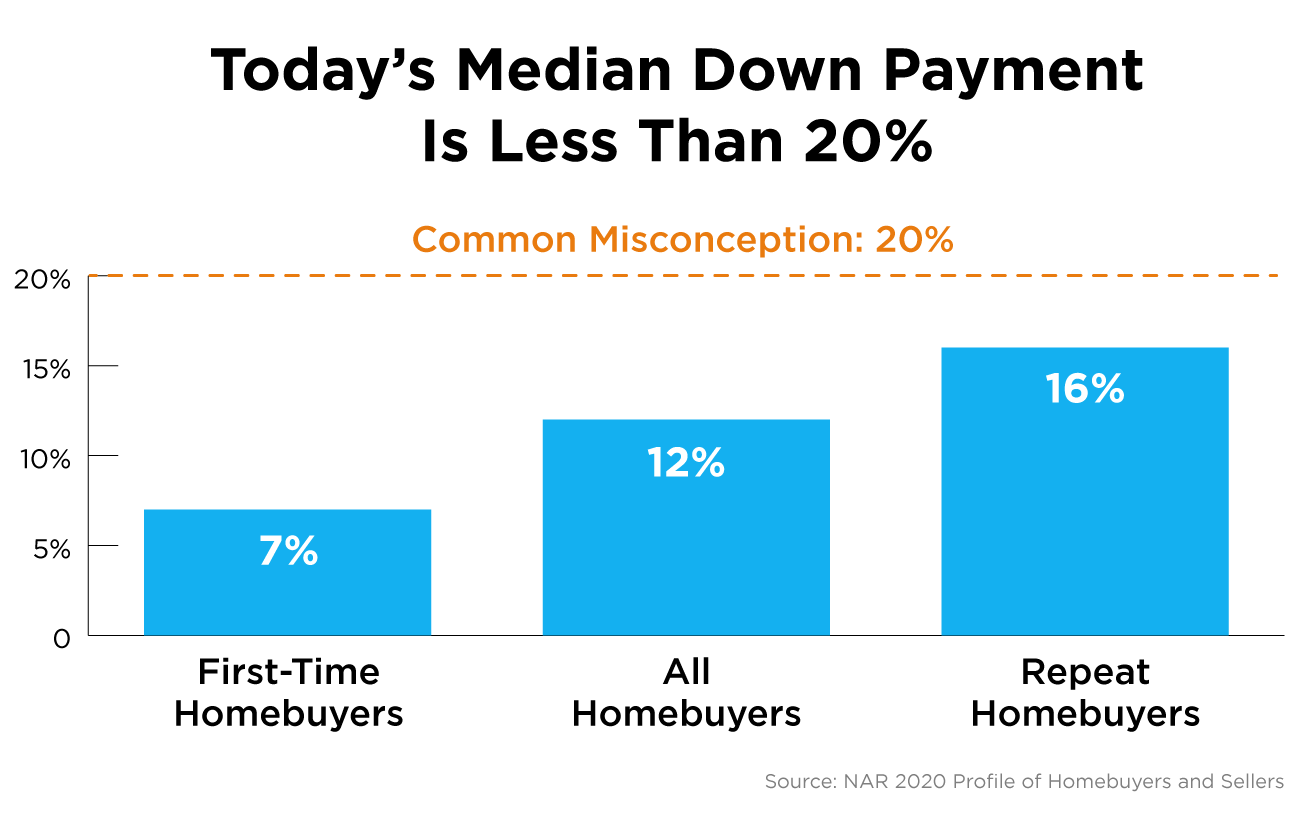

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. What many renters don’t realize, though, is the financial power of equity.

As a homeowner, your monthly mortgage payment becomes a form of ‘forced savings’ you can reinvest later in life as you see fit. You can use it in a variety of ways, like to fund a loved one’s education, move up to a bigger home, or start your own business. As a renter, you’re actually growing your landlord’s equity instead of your own.

If you’re ready to put your monthly payments to work for you and take steps toward those dreams and goals, purchasing a home may be the way to go, especially as rental prices continue to rise.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth. Let’s connect to determine if homeownership is the right choice for you this year.

Content previously posted on Keeping Current Matters

![Why It’s Easy to Fall in Love with Homeownership [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/02/11131152/20210212-KCM-Share-549x300.png)

![Why It’s Easy to Fall in Love with Homeownership [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/02/11131155/20210212-MEM.png)

![Thinking about Building a New Home? Your Agent Is Critical. [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/02/04140720/20210205-KCM-Share-549x300.png)

![Thinking about Building a New Home? Your Agent Is Critical. [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2021/02/04140722/20210205-MEM.png)