What To Do If Your House Didn’t Sell

Some Highlights

- Last year, as many as 1 in 3 sellers took their home off the market because it wasn’t selling.

- If this happened to you too, you don’t need to be embarrassed. What you need are answers. And a local real estate agent can help with that by seeing if it was priced too high, needs some repairs, or didn’t get the right exposure.

- If you still want to move, connect with an expert agent to come up with a new strategy. Together, you can get your house sold.

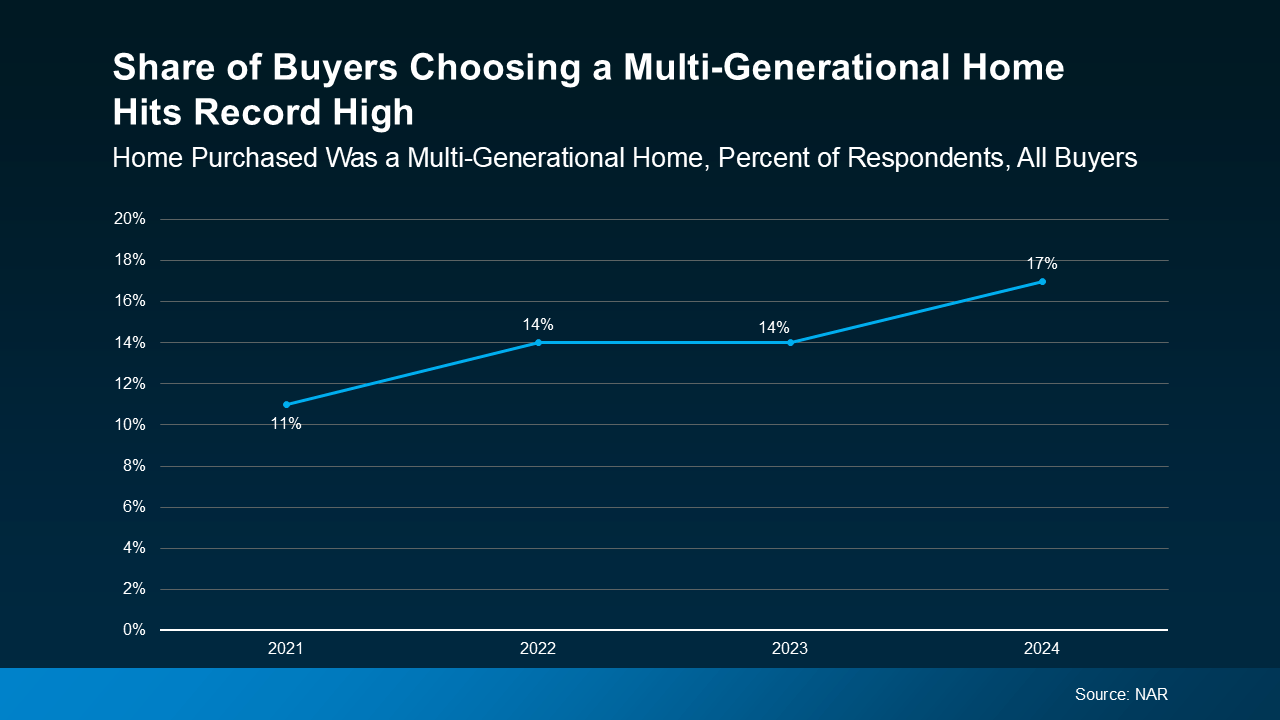

Top Benefits of Choosing a Multi-Generational Home

Top Benefits of Choosing a Multi-Generational Home